[ad_1]

- Buyers are funnelling funds into Brief-BTC merchandise after fourth consecutive week of outflows

- With the Shanghai Improve coming quickly, buyers will likely be cautious with ETH

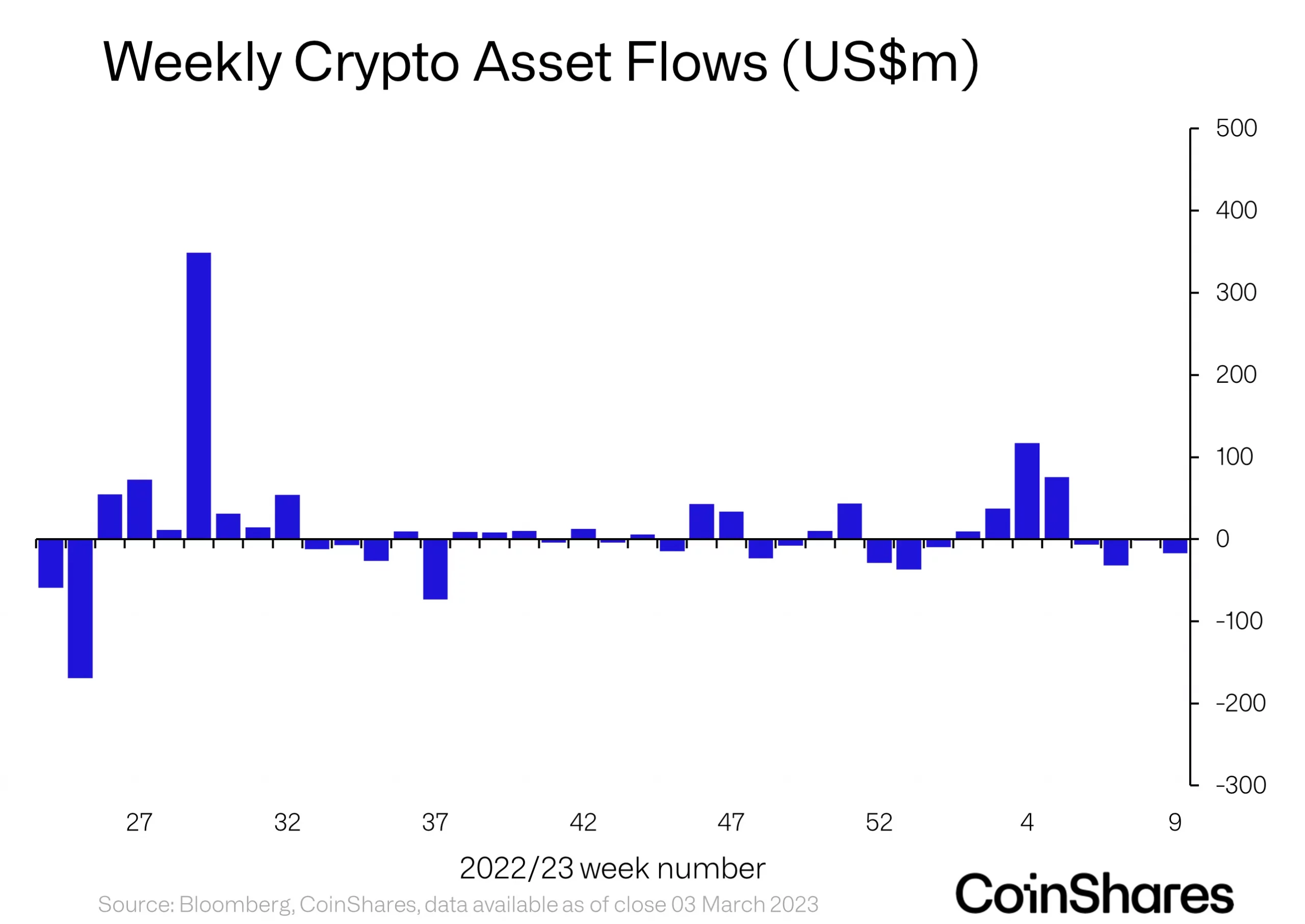

In a brand new report, digital asset funding agency CoinShares discovered that ongoing apprehension amongst buyers relating to the unsure regulatory panorama of crypto-assets led to a fourth consecutive week of outflows for Bitcoin [BTC]. This, as buyers rallied round quick funding merchandise as an alternative.

The worth of BTC sharply declined within the early buying and selling hours of three March, inflicting investor confidence within the coin’s short-term value rally to drop even additional as a result of uncertainty round Silvergate Capital. This occasion contributed to lengthy liquidations hovering to a seven-month excessive, knowledge from Coinglass revealed. Based on CoinShares,

“The poor sentiment possible represents continued investor considerations over regulatory uncertainty for the asset class.”

To quick or to not quick?

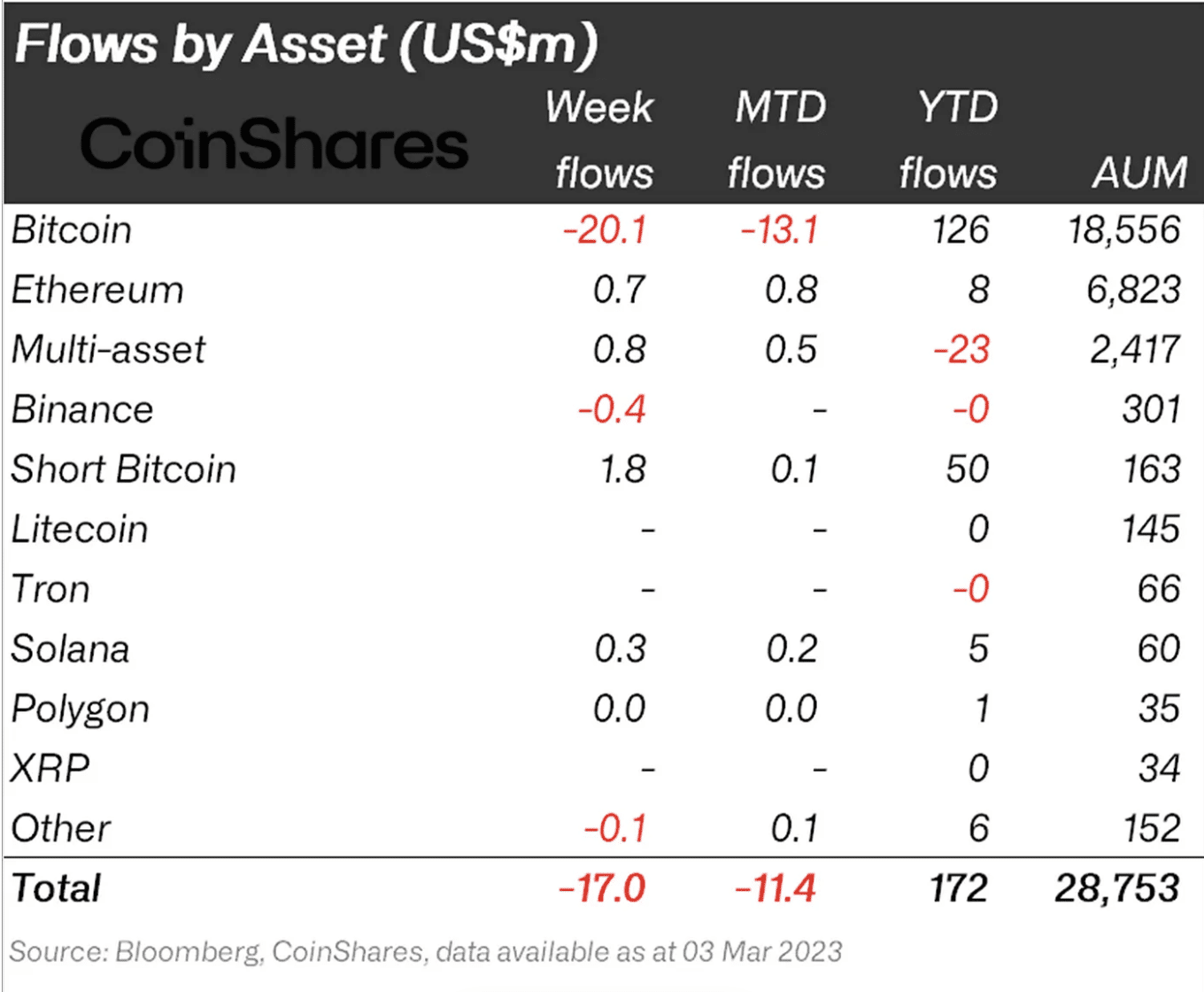

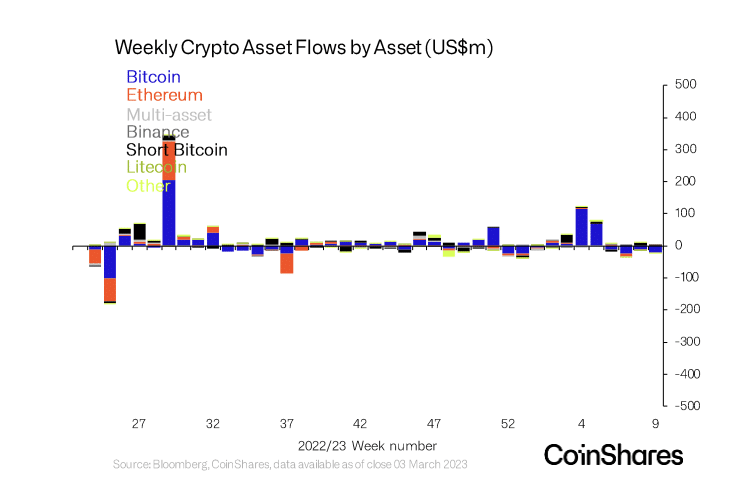

Based on CoinShares, final week, buyers funnelled funds into Brief-Bitcoin merchandise. In consequence, Brief-Bitcoin noticed inflows of $1.8 million. On a year-to-date foundation, Brief-Bitcoin merchandise have logged inflows of $50 million.

Apparently, regardless of the latest inflows into Brief-Bitcoin, the worth of its whole property beneath administration (AuM) has solely risen by 4.2% TYD. This starkly contrasted with Lengthy-Bitcoin AuM, which has hiked by 36%.

Citing considerations over regulatory uncertainty for the asset class, CoinShares added that the discrepancy in efficiency urged that quick positions are but to ship the returns that some buyers predict.

For its half, Bitcoin logged its fourth consecutive week of outflows totaling $20 million. As a result of coin’s spectacular efficiency in direction of the start of the 12 months, its YTD inflows stood at $126 million.

Whereas the whole funding merchandise market suffered low volumes as a consequence of outflows final week, BTC skilled a lower-than-usual market quantity, CoinShares discovered. Based on the report,

“Volumes throughout funding merchandise have been low at US$844m for the week, however the same state of affairs was seen for the whole Bitcoin market volumes, averaging US$57bn, 15% decrease than common.”

General, the low funding product volumes and lower-than-usual BTC market volumes urged that buyers have been exercising warning and would possibly undertake a wait-and-see method.

Minor inflows into Ether forward of the Shanghai Improve

There have been minor inflows into altcoins final week, with Ethereum [ETH] and Solana [SOL] receiving $700,000 and $340,000, respectively. Alternatively, Binance’s BNB and Cosmos’ ATOM logged outflows of $380,000 and $210,000, respectively.

Buyers have exercised warning because the date for Ethereum’s Shanghai Improve is approaching. There’s a normal sense of uncertainty relating to the route of ETH’s value after beforehand locked ETH cash develop into obtainable.

[ad_2]

Source link

![Bitcoin [BTC]: Short products for the win as investors shy away from long positions](https://www.blocpress.com/wp-content/uploads/2023/03/dan-dennis-pZ56pVKd_6c-unsplash-1-1-1000x600-750x375.jpg)